Build generational wealth by tracking Expense to Income Ratio

Are you on track to retire EARLY & COMFORTABLY?

The first question I ask (when someone wants to be Financially Free) is - “What is your current expense-to-income ratio and net wealth?”

If you don’t know these two numbers, you have not even started the journey of Financial Freedom (you might have millions of dollars in your bank). Let’s dissect these two numbers and figure out how far we are from comfortably retiring from the job we don’t like. Btw, if you love your job, you should continue doing it till you die which will give you purpose and meaning in life at the end.

Expense to Income ratio (ETI)

ETI (Yes, I introduced this term) can be calculated using the following formula (you can become a paid member to get access to all the Excel templates & tools) -

We calculate ETI based on monthly expenses and the income part is before TAX. Get a pen & piece of paper and write down all the expenses you incurred last month. Then use the total monthly expense and income to get to the ratio using the above formula. It gives you a clear picture of your current and retirement lifestyle. If you are considering EARLY retirement, I am assuming you don’t want to change your lifestyle that much after you retire like me, but you want to pay off your housing expenses.

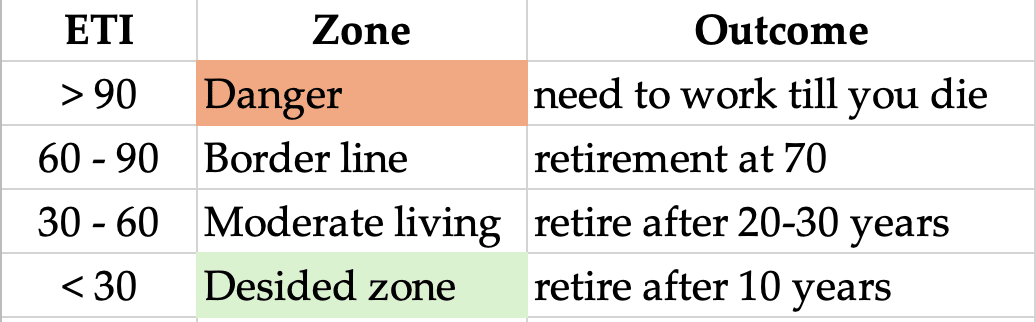

I formulated the above table based on personal observation and calculation. If you are in your early 30s or even 40s, your main goal is to go down to the table and finally reach ETI less than 30. Some of you might be already there (the frugal people - I am here too), but if your ETI is more than 80, you will need to be very serious about cutting down expenses aggressively and increasing your income (focus on creating multiple streams of income too). That’s the only two ways to decrease ETI.

Net Worth

To figure out your net worth, you will need to calculate your total assets and total liabilities. After that, you can calculate your net worth using the net worth formula (or using the Excel file below) :

Your net worth should be at least 25 times your annual expenses during retirement years based on Fidelity [1] & Charles Schwab’s research [2]. If you want to retire early and have a meaningful life (wherever you want to spend your time based on your interest, not others), you will need to be strategic about expenses, savings and future income generations.

How to achieve FIRE

You will hear all kinds of calculations and ideas from thousands of people, financial advisors, family members, relatives & friends about retirement. But before considering their advice, the first question you will need to ask yourself is, do you want to live their lives and did they achieve FIRE (Financial Independence Retire Early) already? If not, you should take that advice with a few grains of salt. As for myself, I started working as a Software Engineer in October, 2013. I took an early retirement in September, 2021 (exactly 8 years) from my high-paying tech careers with little more than $1M net worth. I achieved FIRE by doing all the things that are not typical for software engineers. I invested heavily in real estate, learned different types of trading (day, swing, option) and finally long-term investing. I built my real estate and stock portfolio in a way such that I don’t need to work on those areas for more than 1 hour/week. I did lot of trial and error, made few mistakes along the way, learned from them and fixed those like great engineers. If you need to talk to someone about your FIRE plan, my calendar link in the reference section [3]. I also provide coaching for serious entrepreneurs and professionals who want to live life based on their terms & conditions.

Magic Calculation

My returns on investment criteria is more than 20% for both real estate and stock market. And I am very much more picky about my investment now than ever before. But you don’t need to set a high goal like myself when you are just getting started. In the first few years, you don’t want to lose money since this money will be compounded most in your retirement account balance. I am assuming, after maximizing your retirement contribution balance (I will write about it the upcoming post based on the subscriber’s suggestions), you will put your 50% of income into an index fund (last 100 years of index fund returns in USA is above 10%). So these are the assumptions:

Your total yearly expense is Y during your working years, and you will put Y/2 principal (P) into an index fund if you can achieve ETI 30.

Index fund returns is 10% (r) YoY

You will need 25*Y to retire comfortably (target is 14 years : n)

Your first year’s contribution will have 13 years to compound, and I am calling this as C_1 and next year’s contribution will have 12 years to compound. So total balance is:

That’s the magic of compounding, whatever money (P), you are putting into an index fund - your total balance would be doubled of your contribution after 14 years. I cut down my expenses aggressively to just $40K/year so that I can retire with only $1M with little to no income. But other interesting things started to happen, I took up work that is more aligned with my passion like consultancy, teaching, mentoring and both my income and net worth doubled just after 3.5 years (investment returns started to show the value of sound judgment too).

Was it scary? Yes, it was.

But was it worth it? Absolutely :D

Good luck with your endeavor. I hope this post will give you the nudge to the right direction whatever you are choosing next.

[Social]

If you like this post, feel free to share it with your friends using the share button. Add your comments, and feedback in the Substack app or site.

[Inner Circle]

If you are interested in joining our inner circle to know other tips & tricks from group chat, you can become a paid member. And if you want to join a monthly group call and like to get access to all the Financial Freedom tools & resources we use, consider upgrading your membership to a founding member using the subscribe button below.

[Reference]

[1] Fidelity article about retirement savings: https://www.fidelity.com/viewpoints/retirement/how-long-will-savings-last

[2] Charles Schwab article about how much you can spend during retirement: https://www.schwab.com/learn/story/beyond-4-rule-how-much-can-you-spend-retirement

[3] Emran’s Calendar link: https://emranchowdhury.com/30-min-11-career-growth-call

[ETI Calculation]

Reach out to me if you need the ETI calculation file.